does north carolina charge sales tax on food

Candy however is generally taxed at the full. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

South Carolina Collects Sales Taxes From Most Online Retailers Now It Can Get The Rest Business Postandcourier Com

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

. North Carolina doesnt collect sales tax on purchases of most prescription drugs. Services in North Carolina are generally not taxable with important exceptions. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to.

Groceries and prepared food are subject to special sales tax rates under North Carolina law. Twenty-three states and DC. Goods that are subject to sales tax in North Carolina include physical property like furniture home appliances and motor vehicles.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax. Prescription Medicine groceries and gasoline.

Treat either candy or soda differently than groceries. Some examples of items that exempt from North. If the service you provide includes creating or manufacturing a product you may have to deal.

It is not intended to cover all provisions of the law or every taxpayers. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. The transit and other local rates do not apply to qualifying.

Are Food and Meals subject to sales tax. Eleven of the states that exempt groceries from their sales tax base include both candy and. This food is not subject to local and transient rates.

Sales and Use Tax Sales and Use Tax. A local rate of 2 percent sales or use tax is applied to qualifying food for use storage or consumption. Food and beverage tax.

The information included on this website is to be used only as a guide. Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. The Article 43 half-cent Transit.

/5_states_without_sales_tax-5bfc38cbc9e77c00519e5498.jpg)

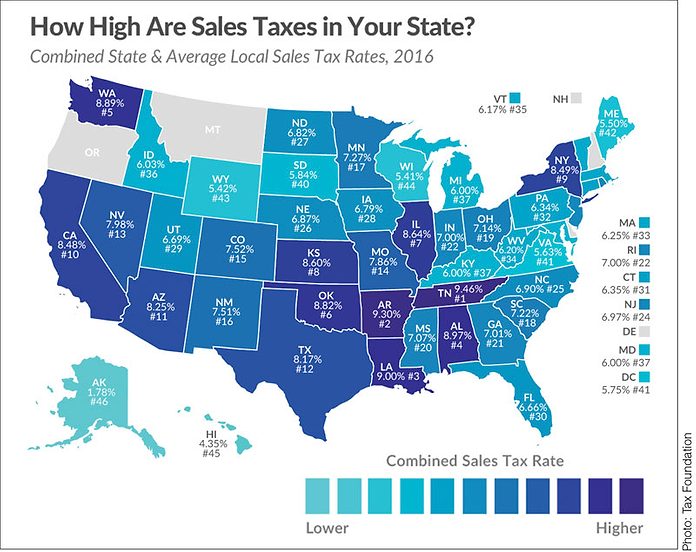

Which States Have The Lowest Sales Tax

Cottage Food Sales Tax Understanding The Basics Castiron

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Avoid Penalties By Staying Aware Of Sales Tax Laws

Limited Special Deduction For Sales Tax And Delivery Fee Beginning In July 2022 In Colorado Cla Cliftonlarsonallen

Etsy Sales Tax When And How To Collect It Sellbrite

Sales Tax Laws By State Ultimate Guide For Business Owners

This Waffle House Menu Has Sales Tax Included R Mildlyinteresting

Etsy Sales Tax When And How To Collect It Sellbrite

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

Is Food Taxable In North Carolina Taxjar

Is Shipping Taxable In North Carolina Taxjar

Tax Comparison North Carolina Verses South Carolina

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

How To Register For A Sales Tax Permit Taxjar

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

General Sales Taxes And Gross Receipts Taxes Urban Institute